Actionable insights are the foundation to investment success. They provide you with direction in a complex market landscape, allowing you to make informed decisions that maximize your returns and minimize risk. By scrutinizing market trends, financial statements, and industry reports, you can identify valuable insights that guide your investment strategy.

Cultivating a keen eye for detail is crucial when it comes to interpreting these insights. Look beyond the surface and investigate the underlying factors that influence market movements.

Additionally, remaining abreast of current events and economic indicators can provide you with a competitive edge.

By embracing these actionable insights into your investment approach, you can position yourself for long-term success.

Maximizing Returns: Strategies for Stock Market Gains

To achieve substantial returns in the volatile world of the stock market, investors must implement prudent strategies and make informed decisions. Diversification remains a cornerstone principle, allocating investments across various asset classes to mitigate risk. Thorough research is essential, encompassing fundamental analysis of companies and understanding market dynamics. Moreover, staying current with financial news and economic indicators can provide valuable insights into potential investment opportunities. Building a long-term perspective and structured approach to investing is fundamental for weathering market fluctuations and maximizing returns over time.

Unlocking Investment Potential: A Guide to Aktien delve into

The world of finance can seem daunting, but mastering the intricacies of "Aktien," which translates to shares or stocks, can unlock substantial investment potential. Investing in Aktien allows you to become involved the ownership of companies, potentially yielding significant profits. To navigate this dynamic landscape, it's crucial to cultivate a solid foundation of knowledge. Begin by examining different industries and pinpointing companies with strong fundamentals and growth prospects. Diversify your portfolio by spreading your investments across various sectors to mitigate risk. Stay informed of market trends and company news, as they can affect stock prices. Remember, successful Aktien investing requires patience, discipline, and a long-term perspective.

- Scrutinize financial statements to assess a company's profitability and stability.

- Track market trends and news that could influence stock prices.

- Utilize reputable online platforms and resources for investment research.

Investment Information: Navigating the Financial Landscape

Venturing into the fluctuating financial landscape can seem daunting, but armed with the proper information, you can steer your way to success. Start by educating yourself about various asset classes. Understand investitionsfreibetrag the volatility associated with each and match your portfolio to your personalized aspirations.

- Spread risk your investments across multiple sectors to mitigate potential losses.

- Continuously monitor your portfolio's performance and make modifications as needed.

- Consult with a financial advisor from experienced professionals to gain actionable strategies.

{Remember|Keep in mind|Always bear] that patience and long-term thinking are crucial for achieving your financial targets. Stay informed, stay engaged, and exploit the opportunities presented by the ever-evolving financial world.

Securing Your Future: The Power of Strategic Investments

A secure future is not a matter of luck. It demands proactive steps, particularly when it comes to your finances. Investing wisely is paramount in achieving long-term financial stability and realizing your dreams.

Through investments that are carefully planned, effectively grow wealth over time. A well-rounded investment strategy incorporating diversification, risk management, and market awareness|are crucial elements in this journey.

- Talk to a qualified professional who can help you develop a personalized plan aligned with your goals and risk tolerance.

- Embrace the power of compounding

The path to financial security is often a marathon, not a sprint. By empowering yourself with knowledge about your investments, you can confidently shape a brighter financial future.

Building Wealth Through Stocks

The world of investing can seem daunting, but it doesn't have to be. Smart traders know that building wealth takes time and knowledge. By carefully analyzing the market and selecting promising assets, you can increase your chances of success. Start by educating about different investment approaches.

- Consider diversifying your holdings across various sectors and asset classes.

- Study companies thoroughly before making any investment decisions.

- Stay informed market trends and cultivate your analytical skills over time.

Remember, smart investing is a journey, not a sprint. Patience are key to achieving long-term success.

Barret Oliver Then & Now!

Barret Oliver Then & Now! Devin Ratray Then & Now!

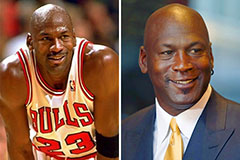

Devin Ratray Then & Now! Michael Jordan Then & Now!

Michael Jordan Then & Now! Catherine Bach Then & Now!

Catherine Bach Then & Now! Nadia Bjorlin Then & Now!

Nadia Bjorlin Then & Now!